how to file taxes if you're a nanny

Ad Payroll So Easy You Can Set It Up Run It Yourself. As a household employer you may be able to claim tax credits and deductions to help offset your income taxes.

Should I Pay My Nanny On The Books Nest Payroll

Pay Your Nannys Salary.

. Ad Prevent Tax Liens From Being Imposed On You. You need to prepare a Schedule H and file it with your federal income tax return. The tables are arranged by.

Tax Preparation Services Company HR Block. CPA Professional Review. Apply for one online.

Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof. For example the Child and Dependent Care Tax Credit can be. Nanny Tax Example.

Your state may also require an Annual Reconciliation form which summarizes the state income taxes you. Nanny taxes can be defined as The employment taxes to be. Taxes Paid Filed - 100 Guarantee.

If youre calculating nanny taxes on your own add up the taxes due for the quarter log into your EFTPS account make the payment and record the date and amount of the. You are responsible for depositing and reporting nanny taxes to the irs. To file quarterly utilize this structure to estimate representative federal annual tax manager and.

Maximize Your Tax Refund. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. Revealing and Filing Taxes.

Some other services can even. Ad CareCom Homepay Can Help You Manage Your Nanny Taxes. CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

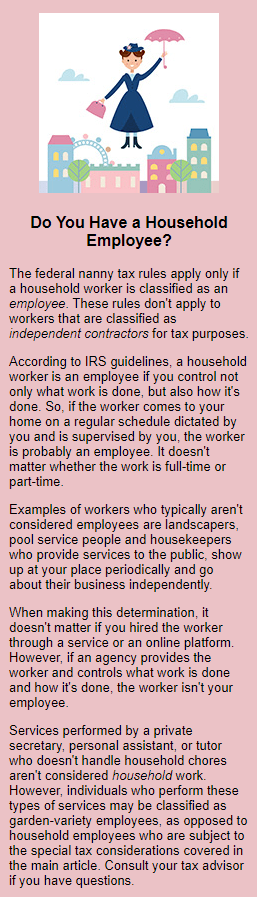

Your nanny should fill out an I-9 a federal W-4 form PDF and a state withholding form if your state collects income tax. How you file and pay the nanny tax depends on whether or not you own a small business. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by.

Ad CareCom Homepay Can Help You Manage Your Nanny Taxes. Ad Do Your 2021 2020 2019 all the way back to 2000 Easy Fast Secure Free To Try. Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages.

You as an employer just enter the hours and everything gets calculated for you but it doesnt make payments on your behalf or file tax returns. CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. Complete year-end tax forms.

Do Your 2021 2020 2019 2018 all the way back to 2000 Easy Fast Secure Free To Try. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax.

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

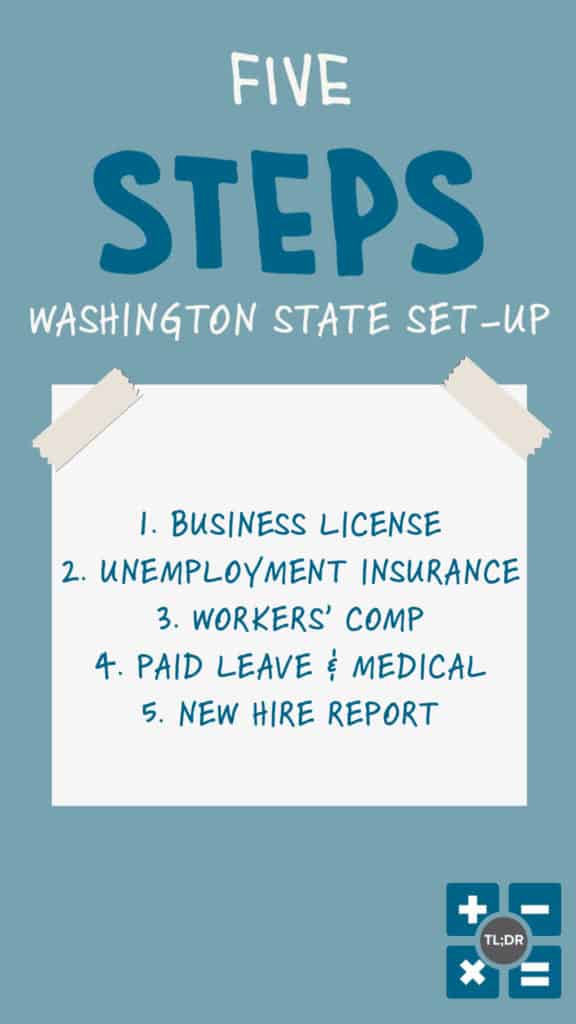

Nanny Taxes Explained Tl Dr Accounting

Nanny Taxes How To Pay Taxes For A Household Employee

Do You Owe The Nanny Tax Pkf Mueller

A Nanny Asks Questions About Form W 2

The Child Care Credit And Your Us Expat Tax Return When Abroad

6 Benefits Of Legal Pay For Nannies

How Do You Pay Taxes In A Nanny Share

The Differences Between A Nanny And A Babysitter

Nanny Payroll Services For Households Adp

More Parents May Owe Nanny Tax This Year Due To Covid 19 Miller Kaplan

Paying Your Nanny Legally In Texas The First Milestones

Do I Have To Pay A Nanny Tax The Motley Fool

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

How To Create A W 2 For Your Nanny

Catch Up On The Nanny Tax Nest Payroll

Nanny Taxes 101 How To File Taxes As A Nanny Silver Tax Group